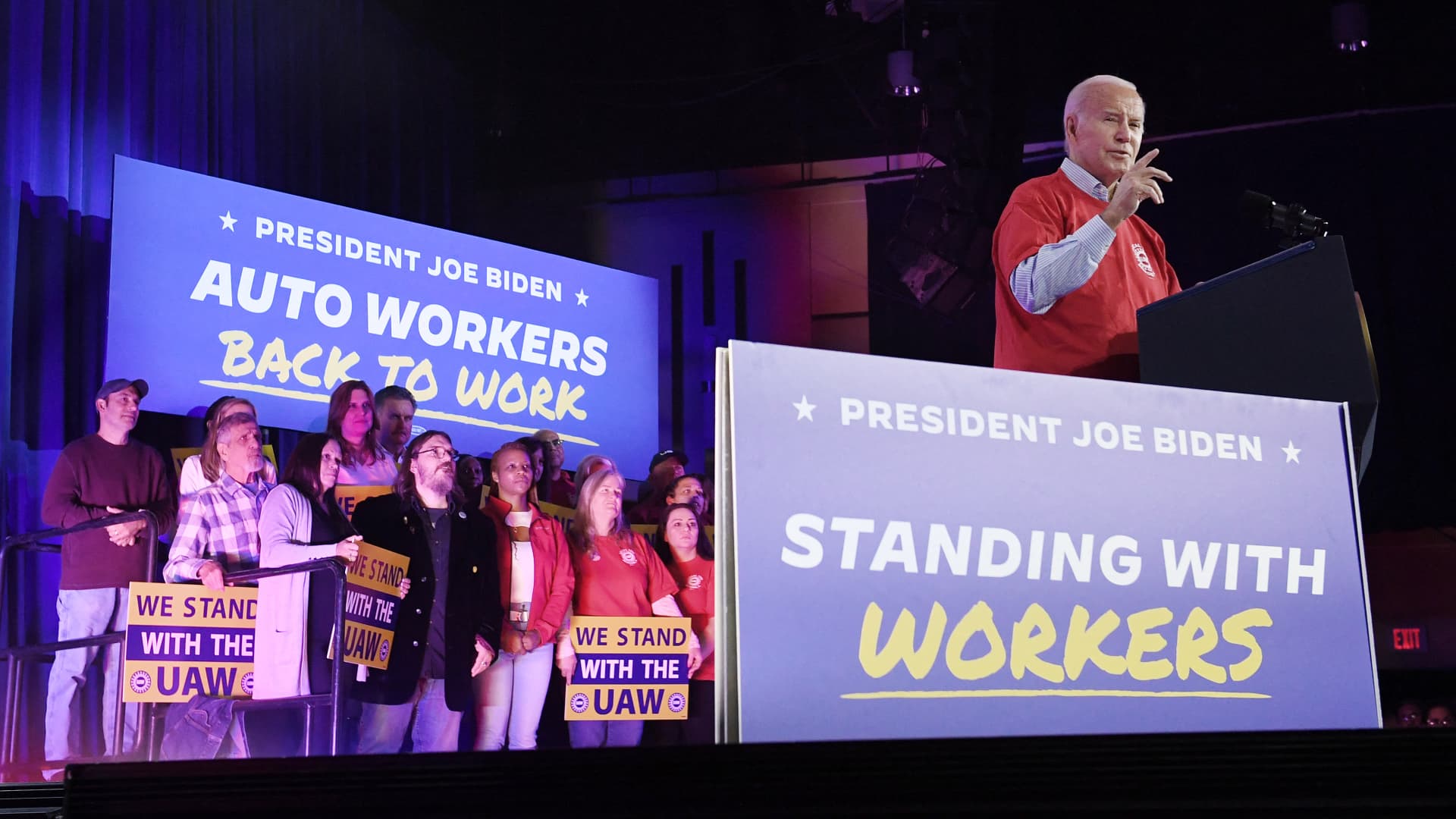

US President Joe Biden speaks about the economy and the deal between the United Auto Workers (UAW) Union and the big-three automakers, in Belvidere, Illinois, on November 9, 2023.

Olivier Douliery | AFP | Getty Images

This report is from today’s CNBC Daily Open, our international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

What you need to know today

Google renames Bard

Google rebranded Bard, its artificial intelligence chatbot and assistant to Gemini, the same name as the suite of AI models that power it. The changes are a first step to “building a true AI assistant,” said Sissie Hsiao, a vice president at Google and general manager for Google Assistant and Bard.

Japan’s zombie problems

Despite strong performance since the beginning of 2023, Japan’s stock market faces several issues over zombie firms. This comes as the Bank of Japan is widely expected to raise interest rates this year — for the first time since 2007.

Biden pushes back

U.S. President Joe Biden in a White House address said his “memory is fine,” and disputed a special counsel’s claims that he willfully retained classified material at his Delaware home. Meanwhile, former President Donald Trump won the Nevada Republican caucus, based on NBC News projections.

[Pro] Bypassing the Magnificent 7

Morningstar’s chief markets strategist David Sekera highlighted that the Magnificent Seven stocks “are starting to run out of steam.” Instead, he picked some lesser-known U.S. small caps, which are far more attractive and currently in play.

The bottom line

It seems American CEOs are feeling more upbeat about the state of the economy.

For the first time in two years, the index that measures sentiment among U.S. chief executives has turned positive, the latest Conference Board report showed.

It rose to 53 in the first quarter, up from 46 in the final three months of 2023. A reading above 50 suggests CEOs have become optimistic about what’s ahead for the economy.

CEOs also cited reduced inflation (34%) and Federal Reserve interest rate cuts (28%) as top developments that might benefit businesses.

The positive turn in confidence is consistent with recent economic data that showed a resilient economy and a robust labor market as well as slowing inflation.

Moreover, the recent slate of stellar corporate earnings have led to a booming stock market, with the S&P 500 briefly crossing the key 5,000-point threshold for the first time.

Despite CEOs’ bullishness, caution also remains.

Asked to identify the biggest business challenge in the U.S. this year, an overwhelming 51% pointed to the upcoming presidential elections.

This isn’t surprising as President Joe Biden confronts a dissatisfied electorate and a challenging political climate nine months before he faces reelection, according to a new national NBC News poll.

Wall Street will have to deal with this uncertainty that will no doubt loom over business sentiment in the months to come.