Share this article

A recent study conducted by Visa and Allium Labs suggests that the vast majority of stablecoin transactions are initiated by bots and large-scale traders, not genuine users.

The dashboard, designed to isolate transactions made by real people, found that out of approximately $2.2 trillion in total stablecoin transactions in April, only $149 billion originated from “organic payments activity.”

The same study said that USDC, the stablecoin issued by Circle, has outpaced Tether’s USDT stablecoin in volume. Notably, on-chain analysis from Nansen revealed that the overall volume for stablecoins have surpassed Visa’s 2023 monthly average.

Visa’s study directly challenges the arguments of stablecoin proponents, who claim that these tokens are revolutionizing the payments industry, which is currently valued at $150 trillion.

Despite support and optimism from financial technology firms such as PayPal and Stripe, the data suggests that the adoption of these tokens as a genuine payment instrument is still in its early stages.

“[…] stablecoins are still in a very nascent moment in their evolution as a payment instrument,” says Pranav Sood, executive general manager for EMEA at payments platform Airwallex.

Sood opines that it is possible for stablecoins to have “long-term potential” but its short-term and mid-term focus “needs to be on making sure that existing rails work much better.”

Data from Glassnode indicates that the record $3 trillion of total market circulation assigned to digital tokens at the peak of the 2021 bull market was closer to $875 billion in reality, pointing to a gap between nominal and “real” value between digital assets.

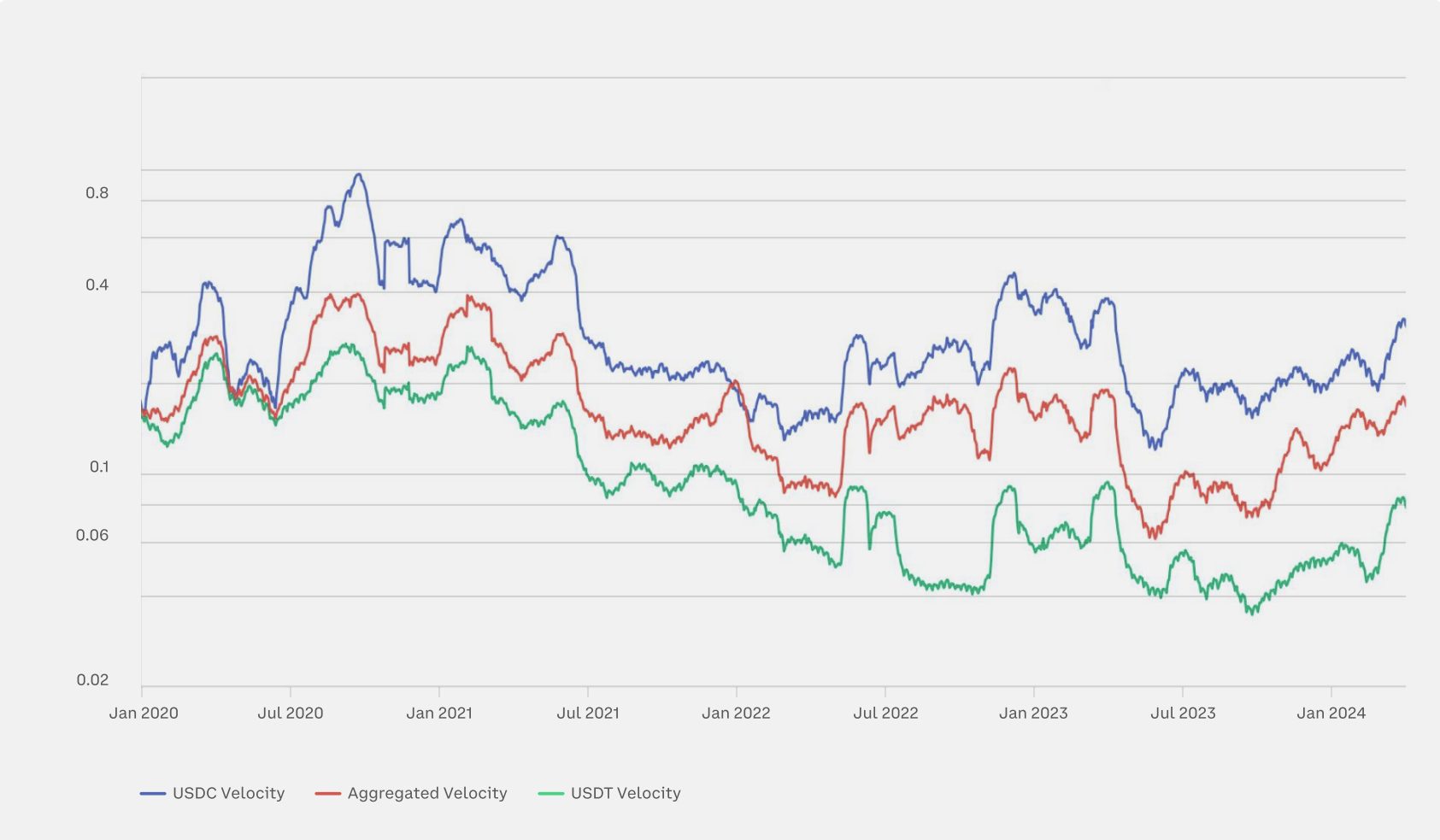

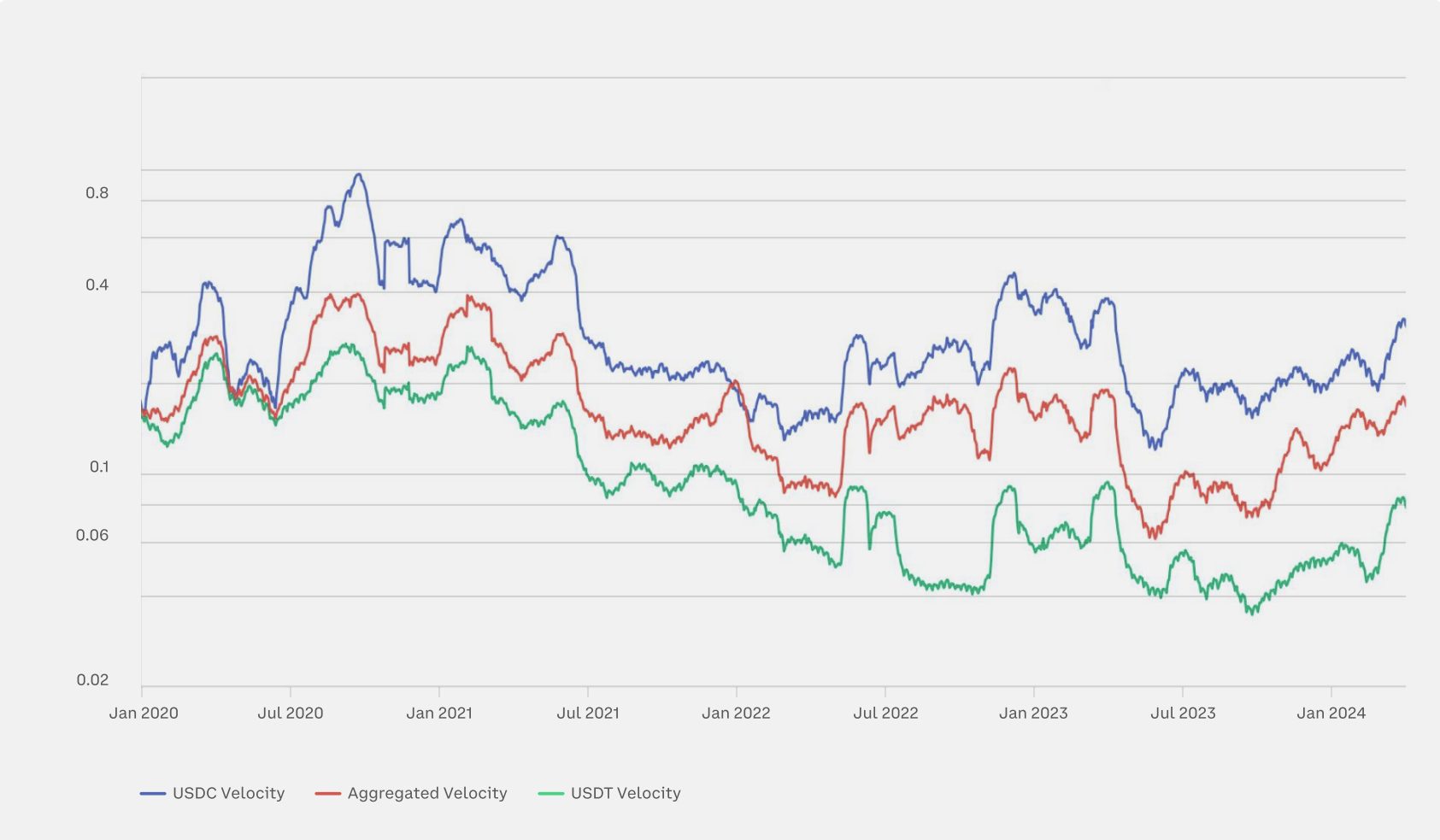

Glassnode also published a Q2 report in which it claimed that stablecoin network velocity, a measure of how quickly value moves around its network, is nearing 0.2 on an aggregated scale. This means that 20% of the total stablecoin supply is processed in transactions daily.

The issue of double-counting stablecoin transactions is also a concern. Cuy Sheffield, Visa’s head of crypto, explained that converting $100 of Circle USDC to PayPal’s PYUSD on the decentralized exchange Uniswap would result in $200 of total stablecoin volume being recorded on-chain.

Visa, which handled more than $12 trillion worth of transactions last year, is among the companies that could potentially lose out should stablecoins become a widely accepted means of payment. Analysts at Bernstein predicted that the total value of all stablecoins in circulation could reach $2.8 trillion by 2028, an almost 18-fold increase from their current combined circulation.

Share this article